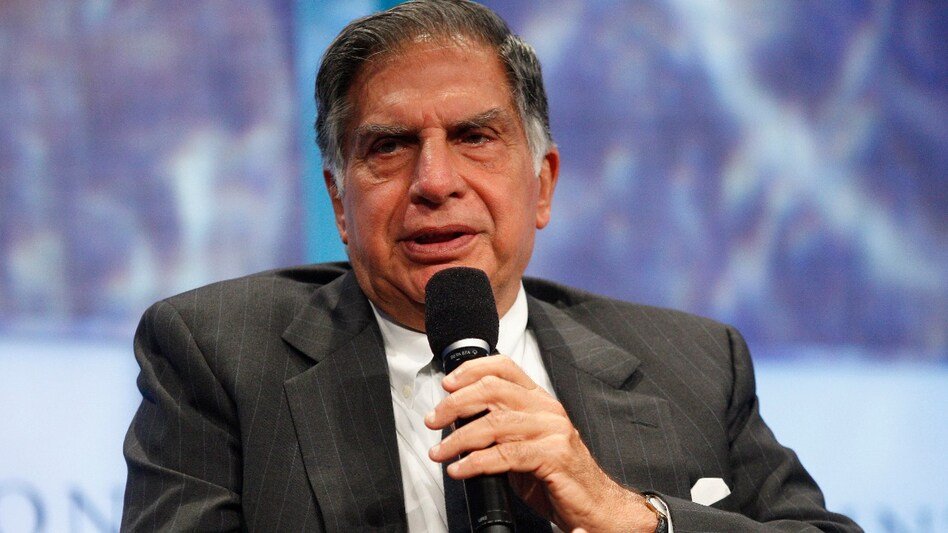

Who is bothering Ratan Tata’s Tata Group? More than 18% of the company has been mortgaged, and it will be sold to Reliance, owned by Mukesh Ambani. The name is…

The Shapoorji Pallonji (SP) Group, the Tata Group’s biggest minority stakeholder, is posing a threat. Their ownership share in Tata Sons is 18.37%. The SP Group has pledged all of its holdings in order to address its debt. The group is asking the RBI to step in and recommend that Tata Sons be listed on the stock exchange.

SP Group On Tata Sons’ Listing

The indebted The IPO of Tata Sons, the Tata Group’s holding business, has once again received support from SP Group. The Economic Times writes that the SP Group has asked the RBI for a listing, claiming that it will be advantageous for all parties involved.

The largest minority shareholder in Tata Sons, SP Group holds an 18.37% stake in the business, valued at Rs 3 lakh crore ($35 billion). The listing of Tata Sons is seen by the SP Group as a way to alleviate its debt-ridden predicament.

Tata Sons Request

Tata Sons applied to the RBI in 2024 to have its Upper Layer Core Investment Company (UL CIC) registration revoked. According to RBI’s NBFC-UL classification, it could be advantageous for them to exclude Tata Sons from the necessity of a public market listing by September 2025.

The SP Group, however, demands that it be included in this important decision and asserts that it was not contacted on it. Tata Sons’ appeal for exemption from listing requirements and request for deregistration are now being considered by the RBI.

SP Group’s Debt

One of the oldest companies in India, the SP Group, has been experiencing financial difficulties. The group works in the engineering, infrastructure, real estate, and construction industries. A large number of them were affected by the COVID-19 outbreak. The crisis increased the group’s debt load and had an impact on cash flow.

The SP Group has begun selling assets to address its debt crisis, including the sale of the majority of Eureka Forbes, the divestiture of Sterling and Wilson Solar to Reliance Industries, the listing of Afcons Infrastructure, and the sale of Gopalpur Port.

Additionally, the SP Group is raising $3.3 billion from credit funds and international banks. In order to obtain funding, it has guaranteed to private credit funds its whole 18.37% interest in Tata Sons.